1. Overview

Cexium is a Solana-native decentralized exchange (DEX) and broader ecosystem enabling ultra-fast, low-fee trading experiences. The CEX token powers protocol incentives, liquidity growth, governance, and utility across products.

2. Vision & Mission

- Vision: A frictionless, community-owned trading stack on Solana.

- Mission: Deliver performance, transparency, and aligned incentives through clean UX and sustainable token design.

3. Architecture

Core components include an AMM engine, routing aggregator, presale and launchpad modules, and staking/rewards systems. The protocol is designed for composability, security, and non-custodial operation.

- AMM with efficient fee tiers

- Order routing and quote optimization

- Liquidity incentives and gauges

- Modular staking and rewards vault

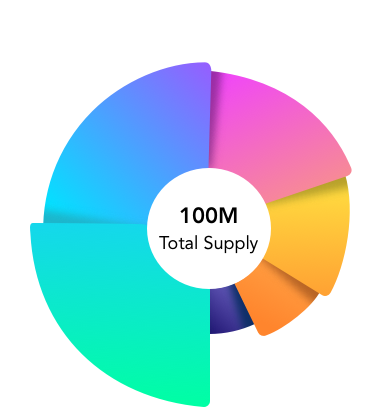

4. Tokenomics

Total Supply: 100,000,000 CEX

- Presale — 40%

- Liquidity — 20%

- Burn — 15%

- Public Sale — 15%

- Airdrop — 10%

Allocations aim to balance launch liquidity, broad distribution, and long-term growth.

5. Token Utility

- Fee rebates and boosted rewards for LPs

- Staking for protocol rewards and governance power

- Access to launchpad allocations and partner perks

6. Presale Details

- Chains: Solana

- Payments accepted: SOL, USDC, USDT

- Listing target: $1.00

- Bonuses for larger purchases (see homepage)

7. Roadmap

- Presale & initial liquidity

- DEX v1 launch & analytics

- Staking + rewards

- Launchpad and partner integrations

- Governance rollout

-

Phase 1 — Presale

Raise, distribute, and provision initial liquidity.

-

Phase 2 — DEX v1

Core swaps, routing, and basic analytics.

-

Phase 3 — Staking

Phase 3 — StakingProtocol rewards and boosted LP incentives.

-

Phase 4 — Launchpad

Partner integrations and fair launches.

-

Phase 5 — Governance

Progressive on-chain governance for CEX stakers.

8. Security

Security-first development: audits before mainnet, guarded launches, continuous monitoring, and responsible disclosures.

9. Governance

CEX stakers will progressively gain voting rights over protocol parameters, reward emissions, and treasury initiatives.

10. Legal

This document is informational and not financial advice. Participation may be restricted by jurisdiction. Always conduct your own research.